MedLawPlus Sample Loan Agreement 2010-2024 free printable template

Show details

Sample Loan Agreement (demand note) Online Loan Agreement Form $12.99 (free trial)--click here LOAN AGREEMENT AND PROMISSORY NOTE THIS LOAN AGREEMENT AND PROMISSORY NOTE, is made this day of, 2010,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your personal loan form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal loan form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal loan form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal loan agreement pdf form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out personal loan form

How to fill out loan forms to print:

01

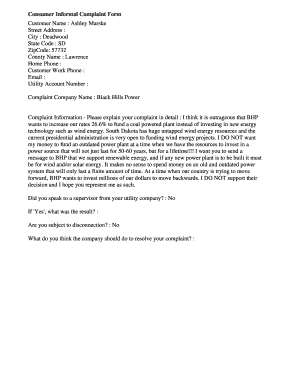

Start by gathering all the necessary information and documents that may be required for the loan application, such as identification proof, income statements, and bank statements.

02

Carefully read the instructions provided on the loan form to understand the specific requirements and sections that need to be filled out.

03

Begin filling out the personal details section, including your full name, contact information, social security number, and current address.

04

Proceed to fill out the employment details section, providing information about your current occupation, employer's name, address, and contact information.

05

If applicable, fill out the income section, including details about your salary, bonuses, commissions, or any other sources of income.

06

Move on to the expenses section, where you might need to provide details about your monthly bills, loan payments, and other financial obligations.

07

If the loan form includes a section for assets and liabilities, provide accurate information about your assets, such as properties or investments, as well as any outstanding debts or loans.

08

Review all the information you have entered to ensure accuracy and completeness.

09

Once you are satisfied, print out the completed loan form.

10

Sign and date the application form as required.

11

Keep a copy of the filled-out loan form for your records.

Who needs loan forms to print?

01

Individuals who want to apply for a personal loan from a bank or financial institution may need loan forms to print.

02

Small business owners who are seeking a business loan may require loan forms to print for their loan application.

03

Students applying for student loans or educational loans might need to fill out loan forms to print.

04

Individuals or families looking for mortgages or home loans may also need loan forms to print to complete their loan application.

05

Anyone who is applying for any type of loan where physical copies of the application form are required may need loan forms to print.

Video instructions and help with filling out and completing personal loan form

Instructions and Help about loan forms template

Fill loan agreement printable : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

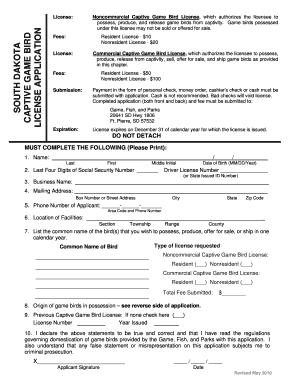

What is loan forms to print?

Loan forms to print are physical documents that individuals or businesses can download or obtain from financial institutions, such as banks or credit unions, in order to apply for a loan. These forms typically include important information about the borrower's personal or business finances, employment status, collateral (if applicable), and the terms and conditions of the loan. Loan forms to print can vary depending on the type of loan being applied for, such as mortgage, auto loan, personal loan, or small business loan.

Who is required to file loan forms to print?

The person or entity that is requesting a loan would be required to file loan forms in order to print them. This could be an individual, a business, or an organization, depending on who is seeking the loan.

How to fill out loan forms to print?

To fill out loan forms to print, follow these steps:

1. Review the loan form: Read through the entire loan form before filling it out. Make sure you understand all the terms, sections, and instructions provided.

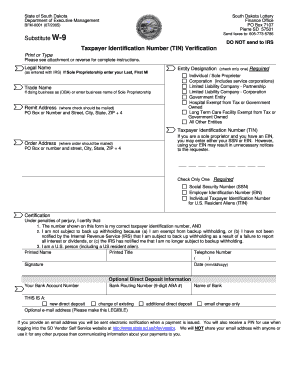

2. Gather necessary information: Collect all the required information and documents that you will need to complete the loan form. This may include personal details, employment information, financial statements, identification documents, etc.

3. Fill out the form digitally: If the loan form is available in a digital format (PDF, Word document, or online form), it is recommended to fill it out electronically using a computer. This will ensure a neat and legible form. Open the file using appropriate software (Adobe Acrobat, Microsoft Word, or an online editor) and enter all the necessary information in the specified fields or sections.

4. Print the form: Once the form is filled out digitally, you can proceed to print it. Make sure you have a working printer and adequate paper supply.

5. Double-check accuracy: Before printing, carefully review each entry on the form to ensure accuracy and completeness. Any errors or inconsistencies should be corrected before printing.

6. Print the form: Click on the print option within the software you are using, or use the keyboard shortcut Ctrl + P (Windows) or Command + P (Mac) to open the print dialogue box. Adjust the print settings according to your preference, such as the number of copies, page orientation, etc. Then, click on the "Print" button.

7. Fill out the form manually: Once you have printed the form, use a pen with blue or black ink to complete any remaining sections or fields that couldn't be filled out digitally. Write legibly and make sure to provide accurate information.

8. Review and sign: Proofread the completed form to ensure that everything is accurate and there are no mistakes. Finally, sign the form wherever a signature is required, using a pen with blue or black ink.

9. Make copies for your records: Before submitting the loan form, make photocopies or scan the completed form for your own records. This will help you keep a copy of the form for future reference, if necessary.

10. Submit the form: Once you have completed the loan form and made copies for your records, send the original form to the appropriate recipient or lender. Depending on the specific instructions provided, you may need to mail it, submit it electronically, or hand-deliver it.

Remember, it is crucial to carefully read and understand the loan form, provide accurate information, and comply with any additional instructions or documentation requirements. If you are unsure about any section or requirement, seek guidance from the lender or consult with a financial advisor.

What is the purpose of loan forms to print?

The purpose of loan forms to print is to provide a physical document that outlines the terms and conditions of a loan agreement between a borrower and a lender. These forms typically include details such as the loan amount, interest rate, repayment schedule, collateral details (if applicable), and any other terms and conditions related to the loan. By printing and signing these forms, both parties acknowledge their agreement to the terms, creating a legally binding contract.

What information must be reported on loan forms to print?

The information that must be reported on loan forms to print typically includes:

1. Personal Information: Full name, date of birth, social security number, contact information (address, phone number, email address), marital status, and number of dependents.

2. Employment Information: Current employer's name, address, contact information, job title, length of employment, and monthly income.

3. Financial Information: Current and previous addresses, monthly rent or mortgage payment, assets (such as savings, investments, or real estate properties), outstanding debts (including credit card balances, student loans, or other loans), and monthly expenses.

4. Loan Details: Purpose of the loan (e.g., home purchase, personal loan, auto loan), loan amount requested, desired loan term, and proposed repayment method.

5. Collateral Information: If the loan requires collateral (such as a car or property), details regarding the collateral, such as make and model of the vehicle or the property address.

6. Credit History: Information about the borrower's credit history, including credit score, existing loans or credit lines, bankruptcy or foreclosure history, and any late or missed payments.

7. References: Names, addresses, and contact information of references who can provide information about the borrower's character and creditworthiness.

8. Consent and Authorization: The borrower's consent to have their credit history checked and verified, acknowledgment of the Truth in Lending Act, and authorization to share information with third parties involved in the loan process (e.g., credit bureaus, loan officers, underwriters).

9. Signatures: The borrower's signature, date of signing, and acknowledgment of agreement to the terms and conditions outlined in the loan application. Additionally, there may be sections for co-borrower or co-signer information and signatures if applicable.

It is important to note that the specific information required on loan forms may vary depending on the type of loan (e.g., mortgage, personal loan, business loan) and the lending institution's requirements.

What is the penalty for the late filing of loan forms to print?

The penalty for the late filing of loan forms to print can vary depending on the specific circumstances and regulations of the lender or governing authority. In general, late filing may result in financial consequences such as late fees or penalties. These fees can range from a fixed amount to a percentage of the loan amount or the remaining balance. Additionally, late filing could also impact your credit score and potentially result in decreased creditworthiness for future loan applications. It is important to refer to the terms and conditions provided by your lender or consult with them directly to determine the specific penalties for late filing.

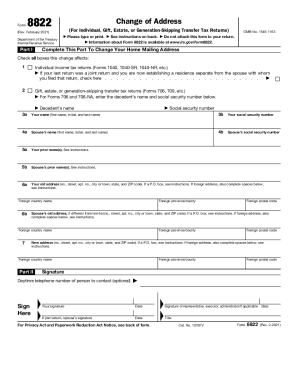

How do I edit personal loan form online?

The editing procedure is simple with pdfFiller. Open your personal loan agreement pdf form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit blank loan agreement on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign personal loan form pdf. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out blank loan form to print on an Android device?

Use the pdfFiller Android app to finish your loan forms to print and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your personal loan form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Loan Agreement is not the form you're looking for?Search for another form here.

Keywords relevant to blank loan forms

Related to blank personal loan forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.